Insurance Litigation Lawyer San Francisco, CA

Dedicated Insurance Litigation Representation

If you find yourself in a dispute with an insurance company over a denied or undervalued health insurance claim, our San Francisco, CA insurance litigation lawyer can help you. When you choose us, you can expect nothing less than 100% effort and genuine dedication. There are many reasons that an insurance company may use to deny or undervalue a claim, but with the help of our attorney, you can fight back and secure the funds that you need. If you’re ready to take this step, contact The Law Office of Bennett M. Cohen today to find out how we can help you with your case.

Table of Contents

We’ll Level The Playing Field

Insurance companies will often find or manufacture any excuse to not pay the value of your claim. Whether they use ambiguous policy language, pretexts claiming that your injury, illness, or disability does not qualify for benefits, or other common bad faith tactics, there are ways to fight back to receive the compensation you are due.

Our San Francisco, CA insurance litigation lawyer has experience negotiating with insurance companies and knowledge of their tactics that are invaluable to receiving the full settlement that you are owed. We will assist you with each step in the process, from counseling you on the best course of action, to evaluating your claim and policy, gathering evidence, negotiating with the insurance company, and, if necessary, bringing the case to court through litigation.

While claims can often be resolved in negotiation with the insurance company, there are instances where the insurance company simply will not agree to pay a fair amount. In these cases, our attorney will assist you with the process of taking the case to court through a lawsuit.

Considering If Insurance Litigation Is Right For You

Often, a lawsuit brought against an insurance company alleges that the insurance company has acted in bad faith, meaning that they have misled the customer, withheld information, or not investigated or paid a claim in a timely manner. A lawsuit may also be brought if the insurance company denies or significantly undervalues a valid claim as per the insurance policy. If the insurance company has engaged in practices such as these and will not relent in their mistreatment of their customer and their claim, then litigation is an avenue to prove and expose the wrongdoing of the insurance company and collect payment for your claim.

While litigation is often a last resort and can be complicated, it is a process worth exploring when all other options have been exhausted. You have rights as the claimant, and your insurance provider owes you a standard of care and service. If these are being violated, it is important to reach out to our lawyer and fight back against mistreatment.

How We Can Help

Our San Francisco insurance litigation lawyer has extensive experience in handling disputes between policyholders and insurance companies. These disputes often arise when an insurance company denies a legitimate claim, underpays, or delays payment unjustly. In such scenarios, the support of our attorney is invaluable. We understand the ins and outs of insurance policies and the laws that govern them, and we’re committed to making sure that policyholders like you receive fair treatment and just compensation.

Experience That Matters

Our insurance litigation attorney is well-versed in both the legal and practical aspects of these cases. We have a strong understanding of insurance law and determine which strategies are best for each case. Our lawyers also stay abreast of the latest legal precedents and regulatory changes, so that they can provide the most current and effective representation. Our responsibility is not just to litigate, but also to advise clients on the best course of action, whether that be negotiation, settlement, or proceeding to court.

Strategies & Solutions

Our attorney will work closely with you to understand the specifics of your case and tailor our approach accordingly. This may involve detailed investigation, gathering of evidence, and expert testimony to strengthen the your claim’s position. Our litigation lawyer is a skilled negotiator and often succeeds in reaching settlements that favor our clients without the need for prolonged court battles. However, when litigation is unavoidable, we are prepared to fiercely represent their clients’ interests in court.

The Value Of Professional Representation

If you want to find the best solution for your situation, having our knowledgeable lawyer to support you at your side can make all the difference. We not only provide legal representation, but also offer peace of mind during what can be a stressful and uncertain time. With our help, you can manage the legal process with confidence, knowing your rights and interests are being vigorously defended. This professional guidance is key to leveling the playing field against large insurance companies that have vast resources at their disposal.

5 Things To Know About Insurance Litigation

The area of insurance litigation law is quite complicated, and it plays a significant role in the way that disputes between insurance companies, policyholders, and other parties are resolved. Whether you are an individual or a business, understanding the key aspects of insurance litigation can significantly impact the outcome of a legal dispute with an insurer.

- Policy Language: Insurance policies are legal contracts filled with industry-specific language and high-brow terms. In litigation, the interpretation of these terms often becomes a central issue. It’s essential for clients to understand the policy language and how courts interpret it. It is common for misinterpretations to result in disputes over coverage details. Legal professionals often engage in detailed analysis of policy language to determine the scope of coverage and the insurer’s obligations.

- The Concept Of Bad Faith: Insurance companies are legally obligated to act in good faith and fair dealing. If an insurer unjustifiably refuses to pay a claim, delays payment, or underpays, they may be acting in bad faith. Litigating bad faith claims can be complicated and requires demonstrating that the insurer’s conduct was unreasonable or without proper cause. In many cases, when a bad faith claim is successful it can lead to financial compensation that far exceeds the insurance policy’s original value.

- The Importance Of Timely Action And Deadlines: Tight deadlines can hinder insurance litigation cases. Policyholders must be aware of the time limits for filing claims and lawsuits, which vary depending on the policy and jurisdiction. Failing to adhere to these deadlines can result in the forfeiture of the right to sue. It is essential to act promptly and seek legal advice as soon as a dispute arises to ensure all deadlines are met.

- Proving Losses: In insurance litigation, the burden of proof lies with the policyholder to demonstrate their loss. This process often involves intricate details and expert testimony. Clients must meticulously document their losses and may need to hire professionals such as appraisers or engineers to support their claims. If you want your claim to be successful, you must be able to adequately and effectively prove your specific losses.

- The Potential For Settlements: Lawyers know that many insurance disputes are usually settled outside of the courtroom. Settlements can offer a quicker resolution and can be less costly than a trial. However, it’s important to understand the value of the claim and not to settle for less than what’s fair. Skilled negotiation is a critical part of the insurance litigation process, and our San Francisco insurance litigation lawyer can play a significant role in achieving a favorable settlement.

San Francisco Insurance Litigation Infographic

San Francisco Insurance Litigation Statistics

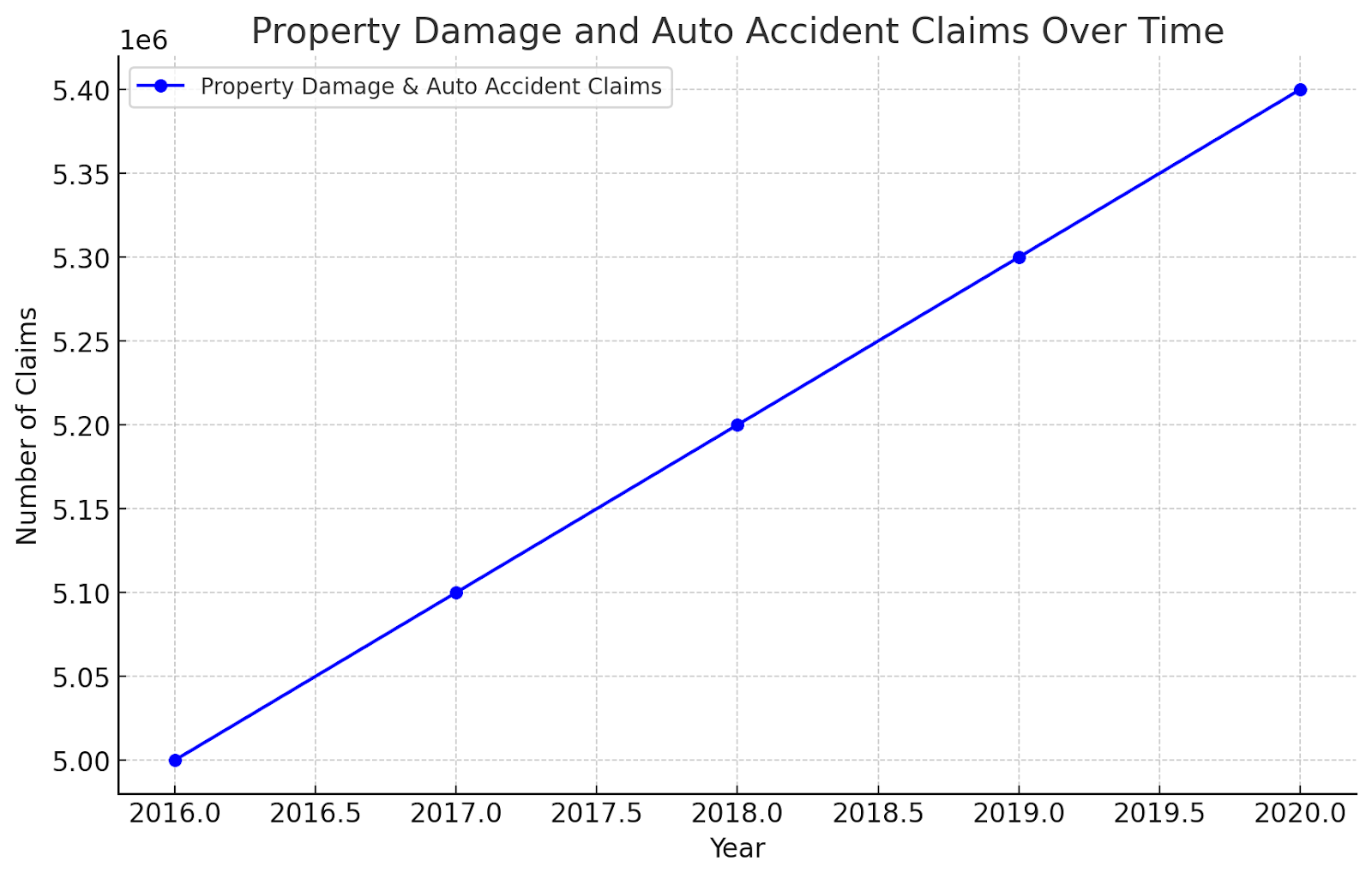

Insurance litigation, which involves disputes between policyholders and insurers, has been a growing area of concern in the legal and financial sectors. In the United States, the frequency of insurance claims and lawsuits has increased in recent years, particularly in areas such as automobile accidents, property damage, and medical malpractice. According to the Insurance Information Institute (III), over 5.3 million claims for property damage and auto accidents lead to an estimated $77 billion in insurance payouts each year. This highlights the ongoing financial implications of insurance litigation.

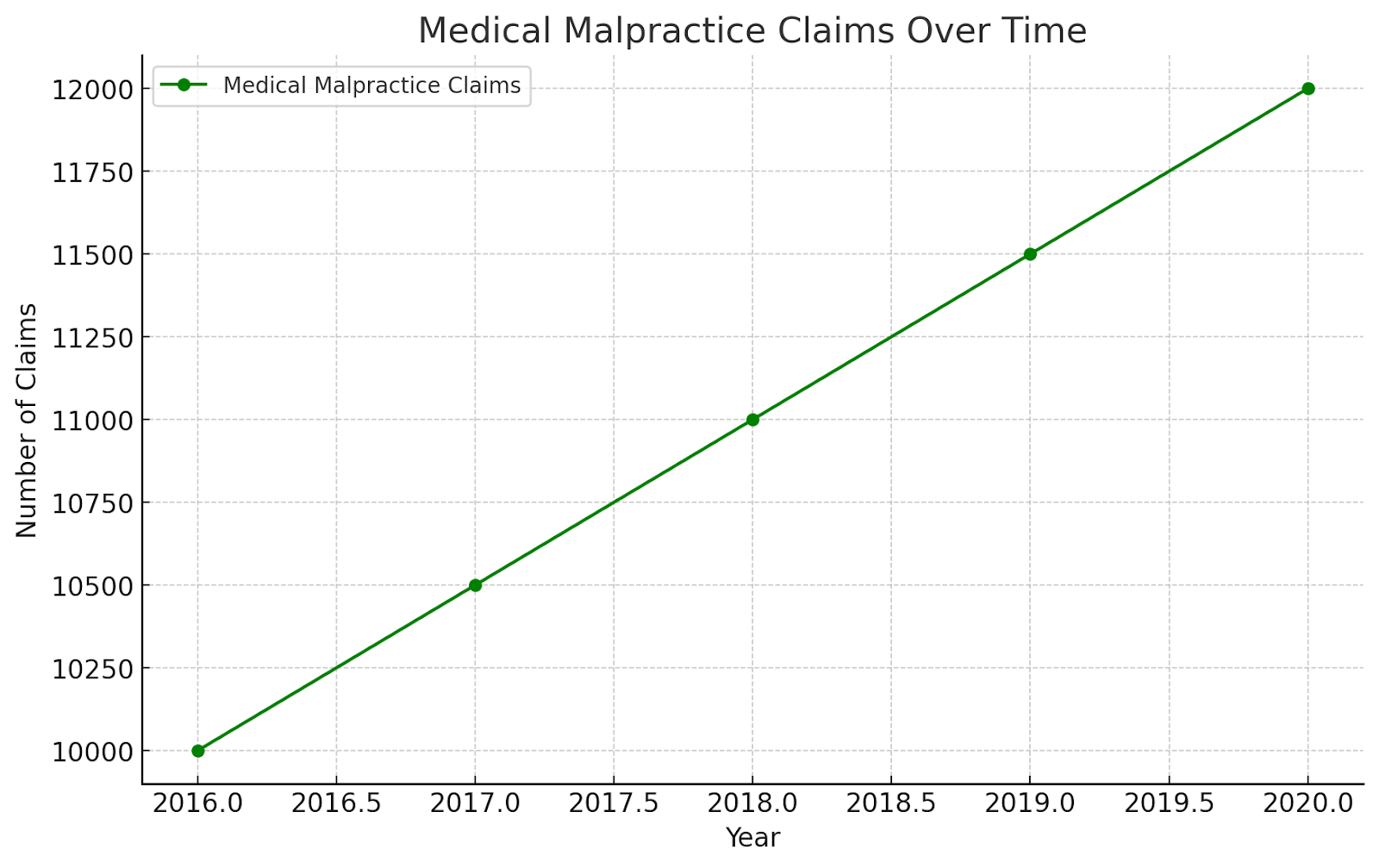

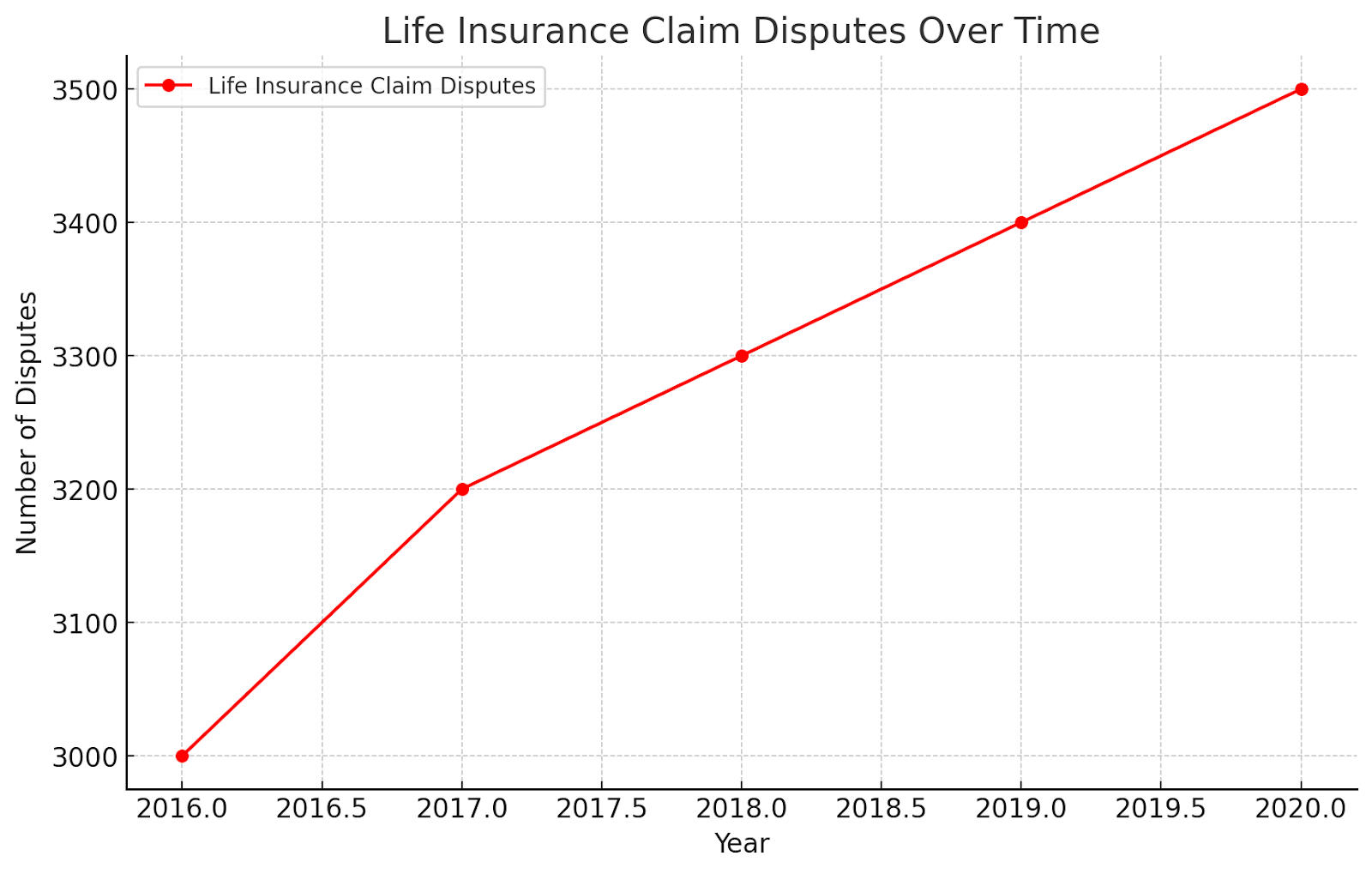

The National Association of Insurance Commissioners (NAIC) also reports that the number of lawsuits related to medical malpractice insurance has risen steadily. In one year, approximately 11,000 malpractice claims were filed across the U.S., with over $4 billion in payouts. Similarly, the frequency of life insurance claims and disputes has steadily increased, with many centered around beneficiary claims and policy interpretations.

Litigation in the insurance sector is driven by factors such as rising healthcare costs, weather-related disasters, and the increasing complications of insurance policies. While insurance companies aim to minimize payout costs, policyholders seek compensation for damages and losses. Legal battles often arise from disagreements over the interpretation of policy terms, claim denials, or delays in settlements.

The following charts illustrate key trends in insurance litigation:

Insurance Litigation FAQs

When faced with a bad faith insurance claim, our San Francisco, CA insurance litigation lawyer knows that it’s natural to have questions. At The Law Office of Bennett M. Cohen, we strive to provide clear answers to our clients’ concerns. When you work with our firm, you know you are getting one person handling your case instead of having your case passed around throughout the office without someone dedicated to working on it. Speak with our team when you are ready to move forward with your insurance case and learn more with our frequently asked questions regarding bad faith insurance claims.

How Do I Know If My Insurance Company Is Acting In Bad Faith?

Bad faith can manifest in various ways, including unreasonably denying a valid claim, delaying payment without justification, failing to properly investigate a claim, or offering a settlement significantly lower than the policy’s coverage. If you suspect your insurer is engaging in unfair practices, it’s essential to seek legal advice promptly.

What Steps Should I Take If I Believe My Insurance Company Is Acting In Bad Faith?

Our insurance lawyer in San Francisco recommends that you document all communication with your insurer, including letters, emails, and phone calls, regarding your claim. Keep records of any evidence supporting your claim, such as photos, medical bills, and repair estimates. Contact our experienced insurance litigation attorney to discuss your situation and explore your legal options.

Can I Sue My Insurance Company For Bad Faith?

Yes, you have the right to file a lawsuit against your insurer for acting in bad faith. However, handling the legal process can be challenging without proper legal representation. Our experienced attorney can assess the merits of your case, guide you through the litigation process, and advocate for your rights in court.

What Damages Can I Recover In A Bad Faith Insurance Claim?

In a successful bad faith insurance claim, you may be entitled to various damages, including compensation for the amount owed under your policy, consequential damages resulting from the insurer’s misconduct (such as emotional distress or financial losses), and punitive damages designed to punish the insurer for its wrongful conduct.

How Long Does It Take To Resolve A Bad Faith Insurance Claim?

The duration of a bad faith insurance claim can vary depending on various factors, such as the willingness of the insurer to negotiate a fair settlement and the court’s schedule. While some cases may be resolved through negotiation or alternative dispute resolution methods relatively quickly, others may require litigation and could take months or even years to resolve.

San Francisco Insurance Litigation Glossary

At The Law Office of Bennett M. Cohen, we are dedicated to providing strong advocacy for policyholders involved in disputes with their insurance companies. With over 30 years of experience, Bennett M. Cohen has fought to secure rightful compensation for individuals and businesses, holding large insurers accountable for their actions. Below, we provide an expanded glossary of key legal terms often encountered in insurance litigation cases.

Bad Faith

Bad faith occurs when an insurance company violates its obligation to act honestly and fairly in its dealings with policyholders. This legal principle is rooted in the idea that insurers must honor their contracts and treat their clients fairly. Examples of bad faith include:

- Unjustifiable claim denials: Refusing to pay a valid claim without a reasonable explanation.

- Excessive delays: Prolonging the processing or payment of claims without cause.

- Misrepresentation of policy terms: Intentionally interpreting contract language to disadvantage the policyholder.

When an insurer acts in bad faith, the policyholder may be entitled to recover not only the unpaid benefits but also additional damages, such as compensation for emotional distress or financial losses caused by the insurer’s actions. In some cases, punitive damages may also be awarded to punish the insurer and deter future misconduct.

Policy Interpretation

Policy interpretation is the process of analyzing the language and terms in an insurance contract to determine the insurer’s obligations and the policyholder’s rights. Insurance contracts often contain technical jargon and ambiguous clauses, which can lead to disputes about coverage. Courts typically resolve ambiguities in favor of the policyholder, adhering to the principle that the insurer, as the author of the policy, bears responsibility for clarity.

For instance, a clause in a disability policy might describe “total disability” in vague terms, leaving room for interpretation. If the insurer denies benefits based on a narrow reading of this term, legal action may clarify the intended scope, ensuring the policyholder receives the coverage they purchased.

Disability Benefits Disputes

Disability benefits disputes involve disagreements between policyholders and insurers over claims for disability coverage. These disputes can arise when an insurance company denies a disability claim, underpays benefits, or disputes the extent of a policyholder’s disability. Resolving these cases often requires comprehensive evidence, such as medical records, specialist opinions, and testimony from healthcare providers.

Disability insurance policies vary widely in their definitions and coverage, making it essential to carefully evaluate the terms. For example, a policy may define “disability” in terms of the policyholder’s ability to perform their specific job or any job at all. Insurers sometimes rely on overly restrictive interpretations to deny claims. Legal intervention can compel insurers to adhere to the policy’s intent, demanding fair treatment.

Proof Of Loss

Proof of loss is a critical component in any insurance claim, serving as the formal declaration by the policyholder about the extent and nature of their loss. This document typically includes details such as the cause of the loss, its estimated value, and any supporting evidence like photographs, invoices, or specialist evaluations.

Insurance companies frequently challenge the sufficiency of proof of loss documents, leading to disputes. For example, in a claim involving water damage, an insurer might argue that the provided repair estimates are inflated or incomplete. Through litigation, additional evidence and expert testimony can validate the policyholder’s proof of loss and compel the insurer to pay the claim in full.

Settlement Negotiations

Settlement negotiations aim to resolve disputes between policyholders and insurers without resorting to trial. These negotiations are often driven by the strength of the policyholder’s evidence, the insurer’s willingness to compromise, and the potential costs of litigation for both parties.

Insurers often attempt to minimize payouts by offering settlements that undervalue the policyholder’s claim. Legal representation can counter these tactics by presenting a compelling case, backed by evidence and legal precedent, to demonstrate the claim’s true value. For example, an underpayment in a claim for business interruption following a natural disaster may be resolved through skilled negotiation, allowing the policyholder to recover their losses without enduring a lengthy trial.

The Law Office of Bennett M. Cohen, San Francisco Insurance Litigation Lawyer

1438 Market St, San Francisco, CA 94102

Contact Our Firm Today

If you believe your insurance company is acting in bad faith, don’t hesitate to contact us at The Law Office of Bennett M. Cohen for experienced legal representation. Our team is dedicated to protecting the rights of policyholders and holding insurers accountable for their actions. Attorney Bennett Cohen studied with a renowned attorney who had the highest jury verdict in the U.S., so when you work with this office, you are working with someone who is willing to fight for your rights. Schedule a consultation with our San Francisco insurance litigation lawyer today to discuss your case and learn how we can help you pursue justice and fair compensation.

Meet Bennett M. Cohen

San Francisco Personal Injury Attorney

Bennett M. Cohen brings over 30 years of litigation experience which includes representing plaintiffs against massive companies like the Shell Oil Company, Standard Insurance Company, and Metropolitan Life Insurance Company. Bennett M. Cohen brings an experienced and dynamic touch that separates himself from large law firms. He can oversee every aspect of your case, ensuring you receive specialized assistance.

Learn moreDon’t Leave Your Case To Chance

Ensure your case is in the hands of a seasoned professional that will fight for you